So we have talked previously about a highly effective breakout trading strategy – here , now we would like to present a very important reversal trading technique on any technical chart , breakouts are very interesting to trade and so are the reversals from an area of value on any technical chart , below we will learn how this really works and how you can trade this wonderful strategy.

Reversal Strategy –

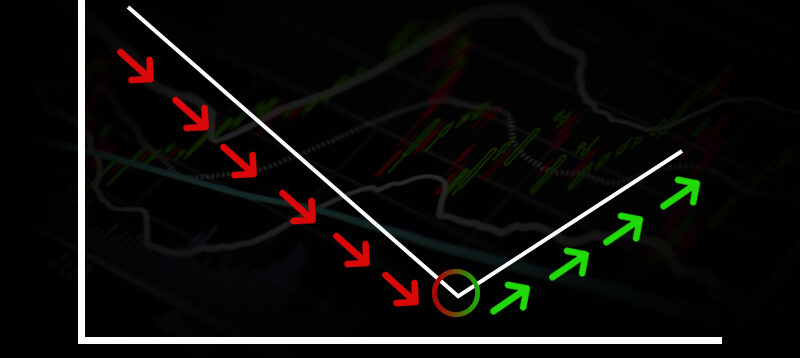

This strategy involves a very good and bullish or bearish move towards a resistance or support level , you must look for the stocks that have moved too fast too soon and have moved towards an area of value , more often you will notice that such strong moves into a support or resistance levels will fail to move above that area of value and will fall flat , here we must make one thing clear that we are not asking you to trade against the trend , this technique is most accurate and profitable in the markets/stocks that are in range , while this can also be used in trending markets we will talk about that with examples below.

Idea Behind the strategy –

Look at the above chart of Adani Port on NSE , look at the candlestick pointed by the arrow , look how the stock moves too fast too soon , what follows ? A selling pressure taking the stock back to the lows of that big candle , So now let us learn what really happened in the background when the stock moved that fast and that too towards a resistance level , what would the BEARS be waiting to do at that resistance ? SHORT ! So when they short around resistance the stock makes a red candle along with this people holding it since before the bullish candle enter their sell orders hence pushing the stock further down , this momentum is further increased when newbie traders who bought at the top because they didn’t wanted to miss the move have their stop losses hit and further fuel the downfall of the stock.

Applying Reversal Strategy in ACC –

Look at the above technical chart of ACC cement on NSE , look how the stock moved too fast too soon and fell tremendously but smack into the support level and next thing what happens ? Stock respects the support and reverses which was fueled by profit booking that is short covering along with stop loss hit of newbies who sold short near the support because of Fear of missing out on the move.See the size of bearish candles moving towards the support , so where will those short traders cover their positions ? At the support obviously and that is what happened.

It goes without saying that you must also look for candlestick confirmation or other indicators for a much better confluence in the trading setup , in the above example there was a bullish engulfing right at support which gave us nice confluence to take a trade.

Applying reversal strategy in Reliance –

Look at above chart of Reliance on NSE , here the stocked moved up too fast too soon but what followed that ? a little consolidation and a big fall , at resistance the bulls booked their profit which caused the stock to slide down combined with the bears who shorted at resistance , the down rally was even more fueled by the hitting of stop losses of the newbies who bought somewhere around the resistance to catch a part of the bullish move.

Summary –

So for trading such reversals you can look for such too much bearish moves towards a support or too much bullish moves towards a resistance ,this strategy is best suited in the sideways market because you wont be trading against the trend , this can also be applied in trending markets , but trade must be taken in the direction of the trend in bullish or bearish markets that is you must look for such strong move into a support in bull market for buying opportunity and bullish move into the resistance in bear market for shorting near the resistance.